Our goal, as a Company, is to create value over the short, medium and long-term, both for ourselves and our stakeholders. The following section provides a summary of our financial performance for the year under review, at both Group and Company level. The information presented below is duly supplemented with the Financial Statements and Notes.

Profitability

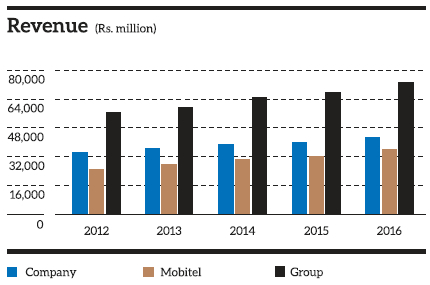

Revenue

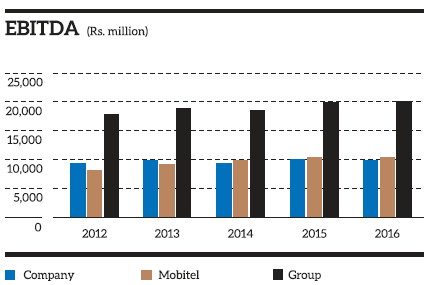

The revenue of the Group increased year on year (YoY) by 8.5%, to record a figure of Rs. 74 billion. SLT, as a company, recorded a revenue of Rs. 43 billion, representing an increase of 6.3% from the preceding year. This could be attributed to the significant investment of Rs. 23 billion we made in introducing new technologies to the market and automating our internal processes through ERP and CRM systems.

Our subsidiary company, Mobitel, recorded a similar impetus in growth, to demonstrate a revenue of Rs. 35.9 billion, representing an increase of 10% from the preceding year.

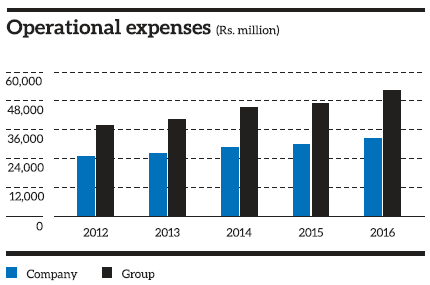

Expenditure

The operating costs of the Group increased by 11.8% to Rs. 54 billion. The operating costs of SLT and Mobitel were recorded at Rs. 33 billion and Rs. 25 billion respectively, which increased by 9.2% and 12% from the preceding year respectively.

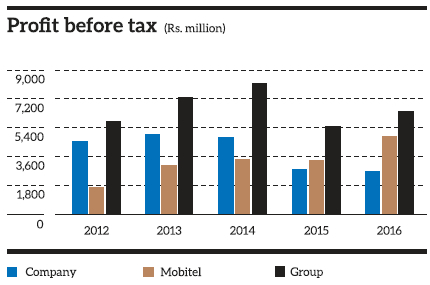

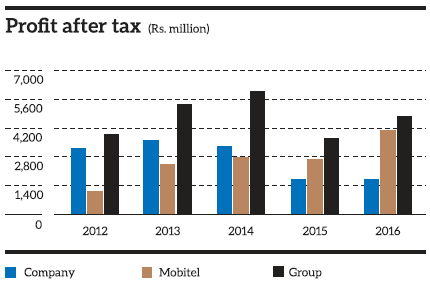

Profits

The Group recorded a profit before tax (PBT) of Rs. 6.5 billion for the financial year of 2016. This was a YoY increase of 17.8%, when compared with the figure of Rs. 5.5 billion recorded in 2015.

The profit after tax (PAT) of the Group was recorded at Rs. 4.8 billion. When compared with the corresponding figure for the preceding year of Rs. 3.7 billion, this represented a YoY increase of 28.6%.

At Company level, the PBT and PAT of SLT marginally declined to Rs. 2.6 billion and Rs. 1.7 billion respectively.

Mobitel recorded a PAT of Rs. 4.1 billion in 2016, compared to Rs. 2.7 billion recorded in the preceding year.

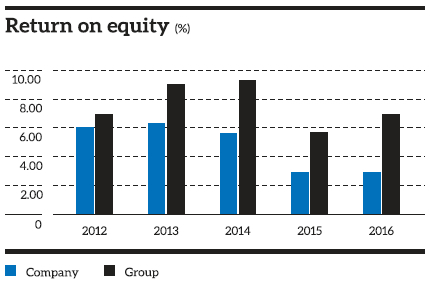

Return on equity

The return on equity (RoE) measures the profit attributable to shareholders as a percentage of their equity. The RoE in 2016 stood at 7.0% from 5.7% in 2015. For SLT as a Company, this was a percentage of 2.9% for 2016 and 2015.

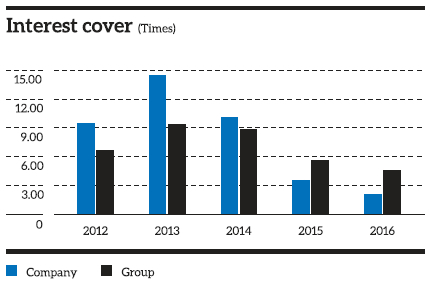

Interest Cover

The Group interest cover was at 4.5 times in 2016, compared to 5.6 times in 2015. For SLT, this was 2.1 times in 2016; contrasted with 3.6 times in 2015.

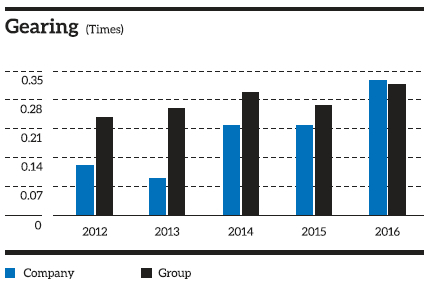

Gearing

The gearing ratio measures the proportion of a company’s borrowed funds to its equity. This was at a ratio of 0.32 in 2016, compared to 0.27 in 2015. At the level of SLT, it was at 0.33 in 2016; an increase from 0.22 in 2015.

Assets

Non-current assets

The total non-current assets of the Group were Rs. 115.4 billion as at 31 December 2016. This was an increase of 9.8% from the figure of Rs. 105.1 billion recorded at the end of 2015. For SLT as a company, the total non-current assets were recorded at Rs. 99.6 billion, from Rs. 88.3 billion recorded in 2015; which represents an increase of 12.9%.

Property, Plant & Equipment

The property, plant & equipment of the Group increased to Rs. 108.6 billion in 2016, from Rs. 99.3 billion in 2015. This represented an increase of 9.4% at an increase of Rs. 9.3 billion. Of this figure, SLT accounted for Rs. 81.5 billion, compared to Rs. 70.0 billion recorded in 2015, representing an increase of 16.4%.

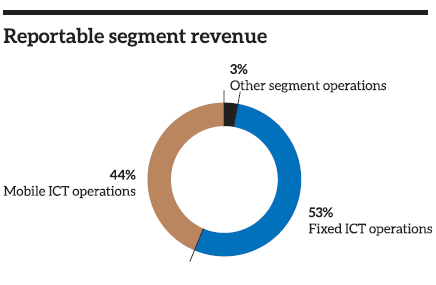

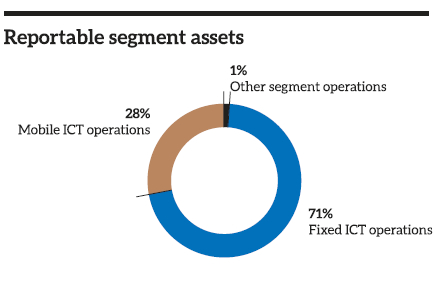

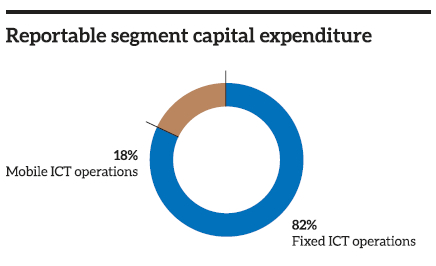

Segmental Performance

The operations of the SLT Group are broken down into fixed ICT operations (the responsibility of SLT) and mobile ICT operations (which is overseen by Mobitel).

Additional information on segmental performance can be accessed from Note 5 to the Financial Statements.

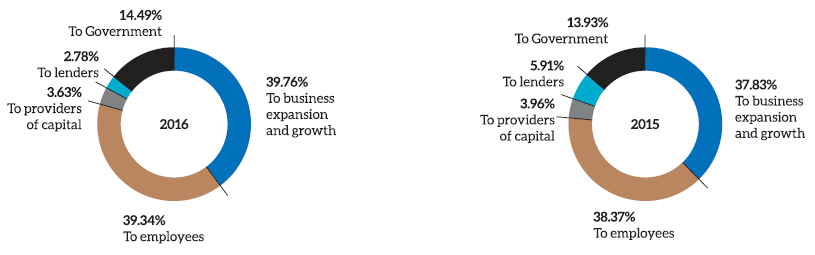

Value Added Statement

|

2016 Rs. million |

% |

2015 Rs. million |

% | |

| Value added | ||||

| Revenue | 73,801 | 68,022 | ||

| Other income | 2,000 | 1,124 | ||

| 75,801 | 69,146 | |||

| Goods and services purchased from other sources | (31,581) | (28,599) | ||

| Value creation | 44,220 | 40,547 | ||

| Distribution of value added | ||||

| To employees | ||||

| – Salaries, wages and other benefits | 17,398 | 39.34 | 15,557 | 38.37 |

| To providers of capital | ||||

| – Dividend to shareholders | 1,606 | 3.63 | 1,606 | 3.96 |

| To Government | ||||

| – Taxes and regulatory fees | 6,403 | 14.49 | 5,649 | 13.93 |

| To lenders | ||||

| – Interest and related charges | 1,229 | 2.78 | 2,398 | 5.91 |

| To business expansion and growth | ||||

| – Depreciation | 14,400 | 32.56 | 13,219 | 32.60 |

| – Retained income | 3,184 | 7.20 | 2,118 | 5.23 |

| 44,220 | 100.00 | 40,547 | 100.00 |

Value Added and Distributed