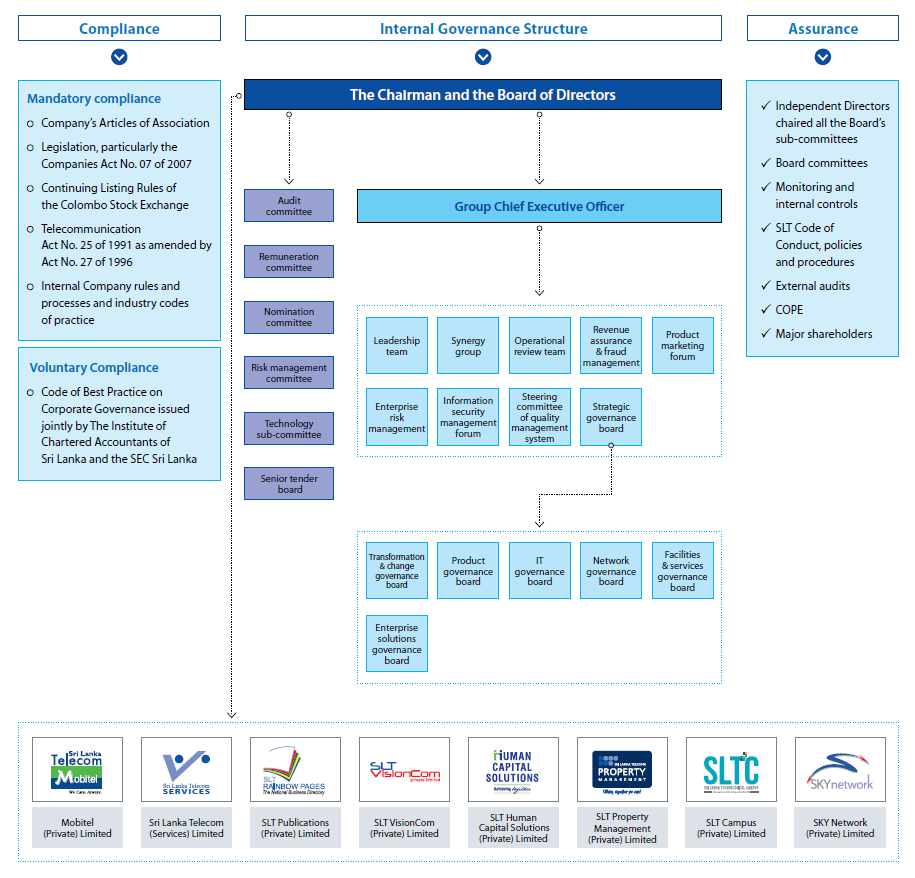

The Board and Management of Sri Lanka Telecom PLC firmly believe that good corporate governance is critical to the sustainability of the Company’s businesses and performance. We are committed to continuously enhance the standards of corporate governance principles and processes so as to improve performance, accountability and transparency of the Company.

This report sets out the key aspects of the Company’s corporate governance framework and practices, with specific reference to the principles and guidelines set out in Section 7.10 of the Colombo Stock Exchange Listing Rules.

The corporate governance philosophy practiced is in full compliance with the following steering instruments on governance:

During the year, the Board comprised the Chairman and eight non-executive Directors (including two Non-Independent Directors). The independence of the Directors has been determined in accordance with the requirements of the CSE Listing Rules.

Ms. Lai Choon Foong was appointed to the Board in May 2014 in place of Mr. Sandip Das who resigned from the Board on 24 April 2013.

Between them, the Directors bring experience and independent judgment at a senior level of business operations making use of their expertise in their diversified areas and international exposure. The Directors provide a strong independent element on the Board. However, the Board operates as a single team.

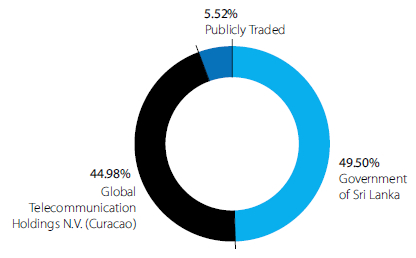

As of the shareholding structure of the Company, two major shareholders namely, the Government of Sri Lanka acting through the Secretary to the Treasury and the Global Telecommunication Holdings NV recommend five and four Directors respectively to the Board. The Board as empowered by the Articles of Association of the Company appoints them to the Board after deliberation of their qualifications, experience and expertise in relevant functional areas by the Nomination Committee. However, all Directors are required by the Company’s Articles of Association to be elected by shareholders at the first AGM after their appointment, if appointed by the Board. A Director must also retire by rotation and may seek re-election at the AGM if he or she was last elected or re-elected at or before the AGM held in the third year before the year in question.

The Board is responsible for the overall conduct of the Group’s business and has the powers, authorities and duties vested in it by and pursuant to the relevant laws of the country and the Articles of Association of the Company. The Board:

The Board has a formal schedule of matters reserved to it for its decision and these include:

Other specific responsibilities are delegated to Board committees which operate within clearly defined terms of reference. Details of the responsibilities and operations of the sub-committees are given below:

The Board met seven times during the year. These meetings, together with any committee meetings, are generally held within a period of three days as determined by all the Directors. Its focus is on the overall strategic direction, development and control of the Company.

The Chairman, along with the Chief Executive Officer and Company Secretary, ensures that the Board functions effectively and has established processes designed to maximise its performance and effectiveness. Key aspects of these processes are:

The attendance of individual Directors at Board meetings and Committee meetings during the year is set out in the table below:

| Board Member | Status | Board Meetings |

Audit Committee Meetings (AC) |

Remuneration Committee Meetings (RC) |

Technology Sub-Committee Meetings (TSC) |

Senior Tender Board Meetings (STB) |

Nomination Committee |

Risk Management Committee (RMC) |

| Mr. Nimal Welgama - Chairman | NED/ID | 7/7 | – | 1/1 | – | – | – | – |

| Mr. Chan Chee Beng | NED/NON-ID | 7/7 | 5/5 | – | – | – | – | – |

| Mr. Jayantha Dharmadasa* | NED/ID | 5/7 | 3/5 | 0/1 | – | – | 0/1 | – |

| Mr. Shameendra Rajapaksa** | NED/ID | 6/7 | – | – | 1/7 | 7/7 | – | – |

| Mr. Kalinga Indatissa*** | NED/ID | 3/7 | 2/5 | – | – | 2/7 | – | 0/2 |

| Mr. Lawrence Michael Paratz**** | NED/ID | 7/7 | – | 1/1 | 7/7 | 7/7 | 1/1 | 2/2 |

| Mr. Jeffrey Jay Blatt***** | NED/ID | 7/7 | – | 1/1 | 7/7 | 7/7 | 1/1 | 2/2 |

| Ms. Pushpa Wellappili | NED/NON-ID | 6/7 | 5/5 | – | – | – | – | 2/2 |

| Ms. Lai Choon Foong (Appointed on 09.05.2014) | NED/ID | 4/7 | 2/5 | – | – | – | – | 2/2 |

* Chairman - Remuneration Committee and Nomination Committee ** Chairman - Senior Tender Board *** Chairman - Audit Committee **** Chairman - Technology Sub-committee |

***** Chairman - Risk Management Committee NED - Non-Executive Director ID - Independent Director |

|||||||

Note: Profiles of all the Board of Directors detailing their areas of expertise are included separately in this Annual Report.

The Board believes that all are currently independent of management and free from any material business or other relationships that could materially interfere with the exercise of their independent judgment. Their profiles demonstrate a range of experience and sufficient calibre to bring the independent judgement on issues of strategy, performance, resources and standards of conduct which is vital to the Group.

In accordance with the Company’s Articles of Association, Directors are granted an indemnity from the Company to the extent permitted by law in respect of liabilities incurred as a result of the performance of their duties in their capacity as Directors to the Company. The indemnity would not provide any coverage to the extent the Director is proven to have acted fraudulently or dishonestly. The Company has maintained Directors’ and officers’ liability insurance cover throughout the year.

In accordance with the Articles of Association, all Directors are required to retire and submit themselves for re-election at least every three years by rotation and also following their appointment. Accordingly, the Directors appointed by the Board during the year and before signing of this Report are offering themselves for re-election at the forthcoming Annual General Meeting.

The roles of the Chairman and the Chief Executive are distinct and the division of responsibility of the CEO has been clearly established, set out in writing and agreed by the Board. The Chairman is non-executive and is responsible for leading the Board and for the effectiveness of the Board ensuring that it meets its obligations and responsibilities. He ensures that Board procedures are followed and all members effectively participate during meetings. The Chief Executive is responsible to the Board for the day-to-day management of the business, leadership of the executive team and execution of the Group’s strategic and operating plans. The Chairman and the Chief Executive meet regularly to discuss any issues pertaining to the Company’s performance, human resources aspects and organisation.

The Company Secretary acts as Secretary to the Board and to the committees of the Board. The Company Secretary:

The appointment or removal of the Company Secretary is a matter for the Board as a whole.

SLT has in place a number of mandatory and voluntary Board sub-committees to fulfil regulatory requirements and for better governance of its activities. These committees meet regularly to consider and discuss matters falling within respective TORs and their observations and recommendations are duly reported.

The Board commenced the year with five sub-committees under the Board: audit, remuneration, nomination, technology sub-committee and Senior Tender Board. The Board has delegated some of its authority to the committees, each of which is filled with Directors who can bring their expertise and experience to the assigned committee.

The Board ensures that internal controls are properly established and maintained through the Audit Committee.

The Board was directly involved in assessing the risks associated with the business and of the Company. However, having identified the importance of managing the risk the Board during the course of the year formed the Risk Management Committee to give more attention to the Group risks.

The duties of the committees are set out in formal terms of reference. They are available on request from the Company’s registered office during normal business hours.

This report as at end 2014, reflects the composition and responsibilities of the sub-committees before the reconstitution.

| Committee | Composition and role | Meeting frequency |

Audit committee |

The audit committee comprises 5 NEDs of whom 3 are independent. Mr. Kalinga Indatissa - Chairman Ms. Lai Choon Foong who was appointed to the committee on 27 June 2014. The audit committee assists the Board in its oversight and monitoring of financial reporting and internal controls. The audit committee report sets out in more detail the audit committee’s policies, practices and areas of focus. The Board through delegation to the audit committee ensures the Board’s overall responsibility for the Group’s system of internal controls and for monitoring its effectiveness. The Board regularly reviews the effectiveness of the Group’s internal controls, which have been in place from the start of the year to the date of approval of this report, and believes that it is in accordance with the Internal Control: Guidance to Directors. |

Six times a year |

Remuneration committee |

The Remuneration committee comprises 3 independent NEDs. Mr. Jayantha Dharmadasa - Chairman The remuneration committee provides support and guidance with regard to the Group’s policy for determining the Directors’ fees for non-executive Directors and Chief Executive and senior management remuneration. The Chief Executive attends meetings by invitation, except when the Chief Executive’s own remuneration package is being discussed. |

Once a year and at such other times as the Chairman of the committee shall require |

Nomination committee |

The nomination committee comprises 3 independent NEDs. Mr. Jayantha Dharmadasa - Chairman The activities of the nominations committee include nomination, selection and appointment of non-executive Directors, Chief Executive Officers and key senior officers, succession planning and the composition of the Board, particularly in relation to the diversity of background, skills and experience. The nomination committee is committed to recruiting and retaining the best people by creating and sustaining an inclusive work environment offering equal opportunities regardless of race, gender, gender identity or reassignment, age, disability, religion or sexual orientation. The nomination committee meets when required. |

Once a year |

Risk management committee |

The risk management committee comprises 5 NEDs of whom 4 are independent. Mr. Jeffrey Jay Blatt - Chairman The risk management committee is responsible for discussing and reporting on the Group’s risks and to manage rather than eliminate the risk of failure and by its very nature can only provide reasonable and not absolute assurance against material misstatement or loss. The Board has established a continuous process for identifying, evaluating and managing the significant risks the Group faces. |

A minimum of four meetings per annum |

Technology

|

The TSC comprises 3 independent NEDs. Mr. Lawrence Paratz - Chairman The TSC comprising 3 NEDs with technical expertise is assigned with the task of studying available technology and providing a platform for engaging in intense technical discussions and looking at road maps with a long-term perspective. Senior management team members, key management personnel, CEO and senior management team members of Mobitel attend meetings of the TSC as permanent members in order to maintain Group synergies when major decisions are made. If required, the CEOs of other subsidiary companies too are invited to attend meetings. Therefore the TSC primarily focuses on: best strategies to increase organisational efficiencies; support the advancement of professional staff capabilities; and develop a flexible delivery system to effectively respond to new technological advances and information. It is also the responsibility of the committee to review the existence and appropriateness of plans, existence and appropriateness of processes, planned and achieved network performance and methods of assessment and the Company’s technology, people and skill plans and their implementation. |

As and when required |

Senior Tender Board |

The Senior Tender Board comprises 4 independent NEDs; Mr. Shameendra Rajapaksa - Chairman The Senior Tender Board (STB), comprises 7 members including 4 NEDs who are also independent Directors. The other three members: the CEO, the CFO and the Chief Corporate Officer (CCO) are appointed by the Board to review the Group procurement needs. The procurement function involves a standard procurement process approved by the Board where, all common procurement processes are consolidated at the Group level for SLT and its subsidiaries. Therefore, in order to increase efficiencies and reduce risk, the Board has delegated the approval limits of procurement as follows: Board of Directors - value exceeding Rs. 50 million |

Prior to every Board meeting |

Following the changes in the directorate and the composition of the Board, the existing sub-committees were reconstituted. The details of the composition of the Board committees after the restructure, is contained under corporate information in the inner back cover of this report.

The management committee teams comprising senior management, key management personnel and others as required provide strategic planning and guidance for day-to-day operations of the Company.

| Leadership team |

|

| Synergy group |

|

| Operational review team |

|

| Revenue Assurance (RA) team |

|

| Product marketing forum |

|

Strategic Governance Board comprising the CEO and the Chief Officers of each functional area is given the responsibility of studying the requirements of cross functional areas and introducing solutions in a transparent manner.

The introduction of six cross functional governance boards has increased efficiencies when introducing processes, projects or investments by eliminating common bottlenecks associated with introducing and implementing new programmes.

The six cross functional governance boards are:

| Transformation and change governance board | |

|

|

| Product governance board | |

|

|

| IT governance board | |

|

|

| Network governance board | |

|

|

| Facilities and services governance board | |

|

|

| Enterprise solutions governance board | |

|

|

Corporate information is also available on the Company’s website: www.slt.lk

The Board seeks to use the Annual General Meeting to communicate with investors and all shareholders are encouraged to participate. The Chairmen of the audit, remuneration and nomination committees will be available at the Annual General Meeting to answer any questions.

SLT held its 17th Annual General Meeting on 9 April 2014 with the participation of approximately 400 shareholders.

The following resolutions were approved at the AGM:

The Board of Directors, as required by the Companies Act, has been disclosing to shareholders all proposed corporate transactions detailing all facts associated with such transactions that are of material value to the SLT. There were no major transactions entered into by SLT for the year 2014.

Though the Board of Directors has applied the related party transactions rules adopted by the SEC on related party transactions throughout its decision-making process to avoid any conflicts of interest that may occur, the Board has recognised the importance of a Related Party Transactions Committee (RPTC) under the Board of Directors to enhance corporate transparency and promote fair transactions between SLT and its subsidiaries. Accordingly, a RPTC was formed comprising three non-executive independent Directors with the objective of ensuring that the interests of shareholders are taken into account when entering into RPTs. RPTC functions under the purview of the audit committee.

The Company has related party relationships with its subsidiaries disclosed in Note 33 to the Notes to the Financial Statements. However, the Board believes those transactions are exempted in accordance with exceptions specified in the Code of Best Practices on Related Party Transactions issued by SEC. All these are recurrent transactions and are in the ordinary course of business of the Company.

SLT is fully compliant with the requirements stipulated in Section 7.10 on ‘Corporate Governance’ of the Continuing Listing Requirements of the Colombo Stock Exchange issued in 2010 and subsequent amendments/guidelines thereto issued by the Securities and Exchange Commission of Sri Lanka. See the table below for the rules on ‘Corporate Governance Principles’ and the degree of compliance to the said rules.

In addition, the Board of Directors to the best of their knowledge and belief satisfied that all statutory payments due to the Government, other regulatory and those payments related to employees of SLT, have been made on time.

| CSE requirements check list for corporate governance | |||

| CSE rule No. | CSE rule | SLT action | Compliance status |

| 7.10 (a), (b), (c) | Compliance with the corporate governance rules | SLT is in compliance with the corporate governance rules | |

| Non-Executive Directors (NED) | |||

| 7.10.1 (a) (b) | 2 or 1/3 of the Board members, whichever is higher, should be NED | All Directors are non-executive Directors | |

| Independent Directors (ID) | |||

| 7.10.2 (a) | 2 or 1/3 of NEDs, whichever is higher, should be independent | 7 out of the 9 non-executive Directors are independent | |

| 7.10.2 (b) | Each NED should submit a declaration of independence | All Independent non-executive Directors have submitted signed declarations confirming their independence | |

| Disclosure relating to Directors | |||

| 7.10.3 (a) | - The Board shall annually determine the independence or otherwise of the NEDs | The Board has determined the independence of NED’s based on their declarations | |

| -Names of IDs should be disclosed in the annual report | Refer Board of Directors’ section of the annual report | ||

| 7.10.3 (c ) | - A brief résumé of each Director should be included in the annual report | Refer Board of Directors’ section of the annual report | |

| 7.10.3 (d) | - Provide a résumé of new Directors appointed to the Board | A brief résumé of Ms. Lai who was appointed as a NED during the financial year was submitted to the CSE | |

| Determination of independence | |||

| 7.10.4 (a-h) | Requirements to meet the criteria to be an independent Director | The independence of the Board of Directors has been determined in accordance with the requirements of the CSE Listing Rules. Accordingly, 7 NEDs are independent. The remaining two Directors namely, Ms. Pushpa Wellappili and Mr. Chan Chee Beng were considered to be non-independent Directors. Ms. Wellappili is an employee of Ministry of Finance and Planning which holds 49.5% stake in SLT through the Secretary to the Treasury and Mr. Chan is a Board Director of Global Telecommunications Holdings NV which holds stake in SLT. However, 7 Directors being more than 1/3 NEDs are independent in compliance with 7.10.2 (a) of the CSE Listing Rules. | |

| Remuneration Committee (RC) | |||

| 7.10.5 (a) | RC shall comprise NEDs, a majority of whom shall be independent | RC comprises independent NEDs | |

| One NED shall be appointed as Chairman of the committee by the Board of Directors | Independent NED is the Chairman of the Committee | ||

| 7.10.5 (b) | The RC shall recommend the remuneration of the Chief Executive Officer (CEO) and EDs | The Board determines the remuneration of the GCEO based on the recommendation of the RC | |

| The Company shall have a RC | None of the Directors are paid remuneration other than the monthly Directors’ fees for attendance at meetings as they are NEDs | ||

| 7.10.5 (c) | Disclosure in the annual report relating to RC | ||

| - Names of Directors comprising the RC | Refer corporate governance section of the annual report | ||

| - Statement of remuneration policy | Refer corporate governance section of the annual report | ||

| - Aggregate remuneration paid to EDs and NEDs | Refer Note 7 to the financial statements | ||

| Audit Committee (AC) | |||

| 7.10.6 (a) | The Company shall have an AC | ||

| Composition of AC | |||

| - Shall comprise NEDs a majority of whom will be independent | The majority of NEDs are independent | ||

| - A NED shall be appointed as the Chairman of the committee | Chairman of the AC is an Independent NED | ||

| - CEO and Chief Financial Officer (CFO) should attend AC meetings | The GCEO, CFO, CIA and the external auditors attended the meetings by invitation | ||

| - The Chairman of the AC or one member should be a member of a professional accounting body | Mr. Chan Chee Beng is a fellow member of the Institute of Chartered Accountants in England and Wales and Ms. Lai Choon Foong is a Chartered Accountant of the Malaysian Institute of Accountants and Certified Practicing Accountants of CPA Australia | ||

| 7.10.6 (b) | AC Functions: | AC carries out all the functions prescribed by this rule | |

| Overseeing the; - Preparation, presentation and adequacy of disclosures in the financial statements in accordance with Sri Lanka Accounting Standards | Refer corporate governance report and the audit committee report | ||

| - Compliance with financial reporting requirements, information requirements of the Companies Act and other relevant financial reporting - related regulations and requirements | Refer corporate governance report and the audit committee report | ||

| - Processes to ensure that the internal controls and risk management are adequate to meet the requirements of the Sri Lanka Auditing Standards | Refer corporate governance report and the audit committee report | ||

| - Assessment of the independence and performance of the external auditors | Refer corporate governance report and the audit committee report | ||

| - Make recommendations to the Board pertaining to appointment, reappointment and removal of external auditors, and approve the remuneration and terms of engagement of the external auditor | Refer corporate governance report and the audit committee report | ||

| 7.10.6 (c) | Disclosure in Annual Report relating to AC | ||

| - Names of Directors comprising the AC | Refer corporate governance report and the audit committee report | ||

| - The AC shall make a determination of the independence of the auditors and disclose the basis for such determination | Refer corporate governance report and the audit committee report | ||

| - The AR shall contain a report of the AC setting out the manner of compliance with their functions | Refer corporate governance report and the audit committee report | ||

Good corporate governance is critical to the sustainability of the Company’s businesses and performance. ![]()